I am offering Paycheck Protection Program Loan Application Assistance, at no cost, to local businesses in Ocean Beach.

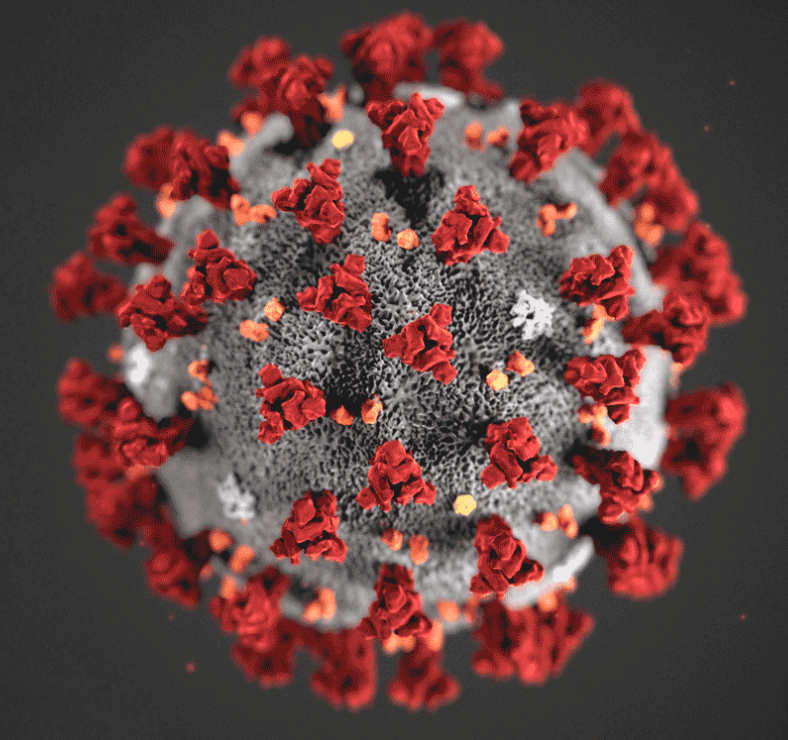

For small businesses impacted by COVID-19 the federal government appropriated 349 billion dollars to small business assistance under a loan program called the Paycheck Protection Program.

The PPP provides small businesses with funds to pay up to 2 months of payroll expenses. The remaining funds may be spent on mortgage interest, rent, and utilities.

PPP Loan Details:

100% forgiven if 75% of loan used on eligible payroll expenses and remaining on mortgage interest, rent or utilities.

Lenders and agents cannot charge any fees to applicant.

All small businesses (including sole proprietors) with 500 or fewer employees are eligible.

Application process opens on April 3, 2020 to small businesses and sole proprietors.

Apply to your local SBA lending institution.

If your small business requires assistance, I ask that you complete the following questionnaire. After completing the questionnaire, I will send you a short engagement letter. Upon execution of the engagement letter, I will be available to answer any questions. It will be your responsibility to submit the loan application and required supporting documentation to your current lending institution.

Any interested Ocean Beach small businesses are urged to contact me immediately. The application process opens Friday for sole proprietorships and small businesses. Lenders are anticipating a large volume of applications and the funds under this loan program may quickly run out.

Lenders are likely to require the following supporting documentation accompanying any loan application. Please begin to assemble this documentation as soon as possible:

· Documents verifying number of full-time employees and payrates.

· Documents verifying payments on eligible mortgage, lease, and utility obligations.

For a more detailed overview of the program please click here.

If you want to learn more as a borrower, please click here.

Your lender will have additional important information likely released tonight or tomorrow morning. Here is a list of top SBA lenders likely to receive priority.

Additional FAQ by JP Morgan Chase.

Click Here to complete the Questionnaire for Loan Application Assistance, at no cost to you.